PayPal has long been the pioneer in digital payments as the parent firm of Venmo. So, what gap is there between the two services Venmo vs PayPal? And which one will be best for you? Is it papal free? PayPal is commonly used for online shopping as a worldwide payment service and transfers money to relatives, families, and business contacts around the world.

Venmo is part of the PayPal.me family, allowing consumers to share personal payments and purchase goods from registered retailers in the US. Venmo vs PayPal are both payment systems that friends, families, employees, or clients can use to receive cash. They are both leading digital wallets, and although they share similar characteristics, the two firms are separated by a variety of variables.

If you’ve found that these payment giants are close, you wouldn’t be shocked to hear that PayPal now owns Venmo. We will look at the difference between Venmo vs PayPal in this article and why specific individuals prefer one network.

PayPal.me, formed as far back as 1998, has long been one of the leaders and most vital players in the payment processing market. And since its purchase of Venmo’s fellow payment app in 2013 as part of Braintree’s acquisition for some $800 million, it seems as if the two concerts Venmo vs PayPal apps have occupied the room.

What is Venmo?

Venmo is a free-to-use payment tool and software that enables users to send and receive funds from friends or contacts and links to the bank accounts and credit or debit cards of users. The app is owned by PayPal and is only open to consumers within the U.S. at present. Unlike PayPal, Venmo, given the (optional) visibility of payments, is a mobile-first operation, primarily optimized for comparatively limited fund transfers with an inherent social component.

The payment service was first developed in 2009 but was introduced to the public in 2012 for iPhone and Android devices as a money transfer app. The P2P (peer-to-peer) market is used by Venmo to allow consumers to exchange payments instantly by adding their bank accounts and/or credit and debit cards to the app. And although there is a minor charge for immediate transactions to cards, the conversion costs are free for bank transfers from the app.

But Venmo has become more of a social media site itself, aside from its simplistic model with users gradually using the colloquial term, “Venmo me” to inquire for payment from the app. And as Venmo officially saw some $19 billion in payments in the final quarter of 2018, the familiarity among users seems to be paying off. Fintech giant PayPal purchased the payment service as part of a wider takeover of fellow payment service Braintree in 2013. Even, how does Venmo vary from PayPal, the parent company?

What is PayPal?

PayPal.me is one of the first payment systems and digital wallets that in recent years have dominated the cash app market. Users can connect their bank accounts and credit or debit cards to their account through the payment service and send and receive payments on mobile devices. In addition, PayPal is expanding to give enterprises and customers additional goods and services.

PayPal, originally the eBay payment processor, has since extended its offerings into an almost bank-like space, selling goods such as loans and business merchandise. PayPal, with over 60 percent market share of payment applications, dominates the fintech space, according to Datanyze. And PayPal definitely has a large client base of some 267 million active customers – not to mention their overall payment volume exceeding $163 billion for the final quarter of 2018.

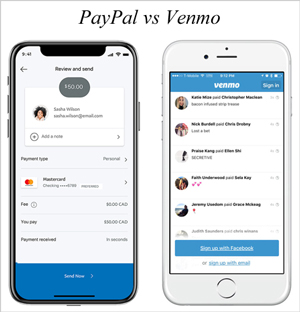

Venmo vs PayPal: What’s the difference?

Venmo and PayPal have lots of parallels, to be sure. For one, they are both parts of the same company, and they share a fee model and general format that are identical.

Here are some of the similarities between PayPal vs Venmo.

Security

When selecting a payment service or cash app, a big consideration for many consumers is its protection. Venmo has bank-grade authentication and confidentiality, and a personal PIN code that the app provides users for mobile purchases, even though there have been a few flags raised in the past.

In comparison, to secure the user’s money, PayPal has a similar authentication and encryption scheme in operation. Unlike Venmo, however, which allows users to register an account, PayPal does not require money transfer from contacts or “friends”

In order to make sure they are using modified data encryption technologies for improved reliability, PayPal uses data servers to constantly search browsers. In addition, when the transaction is finished or sent to notify users that their funds have reached the receiver, the provider will also give users a confirmation email.

Provided that both platforms Venmo vs PayPal have reasonably robust security mechanisms in place, by safeguarding their password and bank or card information, customers may help secure their accounts.

Transfer Limits

Venmo has a significantly lower payment cap than PayPal, allowing customers, similar to PayPal’s $10,000, to transfer up to $3,000 at a time. Venmo is specifically intended to cover both daily sales and transfers, while PayPal is structured for both Venmo vs PayPal daily transactions and greater withdrawals or transfers. The payment restrictions are linked to how the services are intended to be used.

Social

It seems as if there has been something of a sensation surrounding the unexpected social consistency of Venmo that has caused individuals to even return to the app to “follow” their peers or acquaintances on other sites as they can.

Although PayPal does not have this same public standard, with its public (optionally private) transactions, Venmo has taken on more of a social media-esque persona that encourages users to add emojis, feedback and likes to their friends’ transactions. The app is usually used for smaller purchases, such as paying a friend back for dinner or a Lyft LYFT trip, considering the social nature of Venmo.

Fees

Venmo and PayPal have identical payment models when it comes to cost. First and foremost, the software for both programs are free to download and use. However, for credit and debit transactions, all systems charge a 2.9 percent fee, but PayPal adds 30 cents for credit transfers and Venmo waives the fee for debit cards, opting not to charge 25 cents for instant debit transfers.

For enterprises using the app to accept orders, PayPal often provides a special collection of vendor fees. Standard payments for the US are 2.9 percent of the amount for selling products online, plus a flat charge depending on the currency used. And you’ll be charged a flat fee of 2.7 percent of the purchase total for in-store sales.

Speed for Withdrawal

Venmo vs PayPal have similar withdrawal speeds; contrary to Venmo’s, PayPal usually has a withdrawal speed of one to two business days. The withdrawal rates of both payment services are on par with, if not higher than, most of their rivals – which usually average between one and three business days.

Business

In addition to people, PayPal was designed to partner with corporations as a means to

allow financial purchases and transactions – so the infrastructure is pretty well suited for business. As well as unique company rates and programs, the payment provider provides many enterprise plans expressly tailored for small enterprises.

Among several other programs, PayPal provides a “Business in a Box” package – which includes payment collection, the option to set up an online marketplace, financial monitoring and coordination and even financing through the PayPal Business Loan or PayPal Working Capital. It is free to sign up for fixed merchant rates and other fees for the plan.

PayPal also offers point-of-sale and credit transfers as well as smart card readers with rates of 2.7% for swipe or check-in transactions, 3.5% plus 15 cents for keyed or scanned transactions and a 2.7% premium for non-U.S. transactions. Cards and a cross-border tax of 1.5 per cent.

However, far less companies use Venmo for purchases or as payment for products and services. Yet Venmo has much fewer business-oriented functionality compared to PayPal and is more intended for P2P transactions as it does not provide retailers with any special loans or payments.

Special Features

The extension into places that make it behaving slightly more like a bank than a simple app is one big feature of PayPal’s growing business. PayPal also offers programs such as expanding credit, funding orders, and even providing a MasterCard MA tailored for unique PayPal needs to consumers.

And while Venmo has accounts that usually have the photo of the user and friends or ties connected with it, PayPal also has a shareable connection called PayPal.me that helps people to see who gives them cash or who gets it. Users can give clients, friends or businesses the link and can get charged for following the link. While Venmo has now begun branching into other financial items such as a debit card, in this field it still trails PayPal.

Which Is Best Option Venmo vs PayPal?

It depends mainly on what you’re using the service for, as usual. Venmo provides low fees and a convenient format for individuals who mainly pay comparatively small amounts to contacts or friends, which is commonly appealing to consumers of all ages, especially millennials.

The architecture and functionality of the app are better suited to smaller, everyday transactions than massive sales or transfers, and are intended for use by friends. PayPal, on the other hand, is probably better suited to consumers who are either firms and brokers or users who need to send bigger transactions or share funds for individuals they do not know. The payment service is also suitable for online shopping and provides a broader variety of goods and services (like loans and even a MasterCard).

While both Venmo vs PayPal platforms basically serve similar tasks, Venmo is theoretically best for consumers who only want to send and retrieve smaller sums of money with minimal to no payments everyday, while small companies or consumers who make a lot of online or major orders and transfers may choose to go for PayPal.