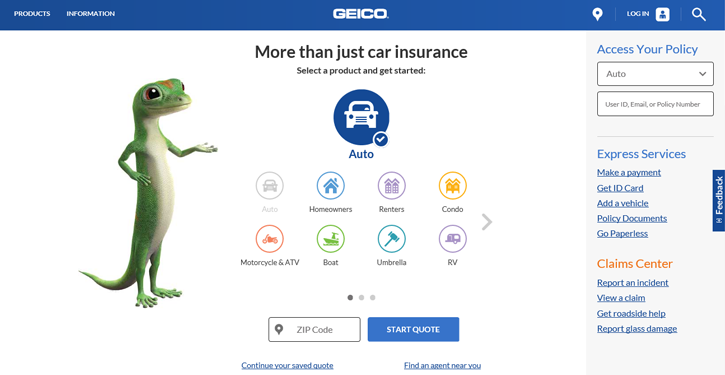

You’ve probably heard of Geico insurance if you’re looking for car insurance. Our review team looked closely at the Geico insurance reviews, as well as the company’s rates, coverage options, and reputation in the market, to see how it compares to its competitors.

When it comes to car insurance, we found that Geico usually has some of the lowest prices. In our study of the best car insurance providers in the country, Geico Insurance came out on top. Continue reading to find out more about the business and to discover why we rated it the Best Insurance Provider.

Geico Insurance Review | 2022

Because insurance rates fluctuate naturally, GEICO insurance’s promise that you may save 15% or more is not always true, but overall, according to statistics, GEICO’s average premium is over 20% less than the national average. Young drivers, who sometimes have to cope with excessive rates from other firms, can also take advantage of their very low rates.

Coverage Types:

- Coverage for liability (bodily injury and property damage)

- collision and comprehensive insurance.

- coverage for medical expenses.

- Protection from personal injury

- coverage for uninsured and underinsured drivers.

- road service in an emergency.

- Rental compensation

- Insurance against mechanical failure.

- Motorcycle insurance

- Insurance for an ATV

- RV insurance

- Insurance for drivers of on-demand deliveries and ridesharing

- Insurance for vintage cars

- Insurance for boats and personal watercraft

- Auto insurance in Mexico

- Insurance for fleet vehicles

GEICO Insurance Rates:

Low rates are GEICO’s claim to fame. According to the most recent statistics, the average yearly premium for the bare minimum of coverage with GEICO is $363. The typical price for complete coverage with GEICO is $1,325. Contrast that with the typical cost of the bare minimum of car insurance in the United States, which is $563 annually and $1,738 for full coverage. According to those figures, drivers who go for GEICO save, on average, $200 for the bare minimum of coverage and $413 for complete coverage.

Discounts for GEICO auto insurance

GEICO offers the highest discounts of any established insurance provider, ranging from 5 to 25% off your vehicle rate.

The following are the vehicle insurance discounts provided by GEICO:

- discount on new cars.

- excellent student discounts.

- discount for defensive driving.

- Discounts for good drivers

- The usage of seatbelts is cheaper.

- Savings for many vehicles

- Multiple-policy discount

- savings on vehicle accessories.

- discounts for driver’s education

- military and government service discounts.

- discount for those over 50.

Home Insurance from GEICO

GEICO insurance can protect your house and belongings if something bad happens, like a fire or a break-in. Here are some things that are usually covered by GEICO home insurance, but you should check your policy to make sure:

Coverage Types:

- Fire, wind, hail, and water damage to property (under some policies)

- Personal belongings, including furniture, clothing, gadgets, and dishes

- Jewelry worth up to $2,000.

- personal accountability

- medical expenses

- If you suffer a covered loss, additional expenditures like accommodation charges may be incurred.

Discounts on GEICO’s home insurance

Bundling your vehicle, house, or renters’ insurance policies with GEICO is a simple way to save money on insurance. GEICO insurance may provide you with the following additional house insurance savings:

- discounts on home security systems.

- discounts on smoke alarms and sprinklers.

- offers many policies.

- Military and government employees receive discounts.

- student price cuts.

- Discounts for membership groups

Insurance by GEICO

GEICO Insurance has plans for life insurance, but you should know that the company does not sell or write its own life insurance. Instead, it collaborates with LifeQuotes, a website that compares prices from various life insurance providers.

Coverage Types:

- Complete life insurance

- Long-term care insurance

- Continuity of life insurance

Cost of GEICO Life Insurance

According to the most recent statistics, the average cost of life insurance is around $23 per month for a 35-year-old woman searching for a 30-year term policy with a death benefit of $250,000. NextAdvisor obtained a GEICO quote for life insurance coverage with a $250,000 starting point for a 35-year-old woman who is healthy, resides in California, and is searching for term life insurance. For such a person, term life insurance would cost around $18 per month for 30 years, $12 per year for 20 years, and $9 per year for 10 years.

Discounts on GEICO life insurance

Since it has partners that sell and underwrite life insurance plans for it, life insurance discounts with GEICO may vary greatly.

However, you can benefit from these:

- Multiple-policy discount

- Discounts for members and employees

- Military benefits

- discounts for federal employees.

Other benefits of Geico to think about:

Even though auto insurance is probably Geico’s most well-known service, clients can also get:

Travel insurance: Offered by Berkshire Hathaway Travel Protection, this insurance may assist in covering your expenses for travel, trip cancellations, lost or stolen travel documents, and unforeseen medical expenses.

Jewels insurance: Geico and Jewelers Mutual Insurance Group have joined forces to make it easier for customers to protect their personal and expensive jewellery from being stolen or going missing for no reason.

Pet insurance: Taking care of a pet can be expensive, but insurance for animals may help offset some of those expenses.

Geico works with other insurance companies to offer coverage for most accidents, non-pre-existing conditions, dental care, and other things.

Corporate sustainability at Geico insurance

Through the Geico Philanthropic Foundation, the company works to improve education, community involvement, and fairness, justice, diversity, and inclusion. In the past twenty years, the foundation has given between $6 and $8 million to nearly 7,000 NGOs. If the non-profit meets Geico’s criteria, the company invites policyholders and the general public to submit their 501(c)(3) non-profit organisations for consideration.Nominations are accepted from January 1 to November 30.

GEICO Offers Additional Policies

People who want to keep all of their insurance policies with the same company would benefit from GEICO’s wide range of insurance products and discounts for bundling.

GEICO also provides the following insurance coverage:

- Commercial insurance

- Protection of identity

- Jewelry insurance

- Foreign insurance

- Animal insurance

- Travel insurance

- Supplemental insurance

Geico Alternatives

These three organisations may be a good place to start if you want to compare Geico insurance to other insurance providers before making your choice:

Progressive: Progressive has a lengthy list of car insurance discounts. For customers who wish to save money on both types of policies, Progressive also provides a lengthy list of house insurance discounts.

Esurance: Esurance provides a feature-rich digital app environment that is perfect for customers who wish to handle their own policy.

Nationwide: Utilizing Nationwide’s telematics systems, SmartMiles and SmartRide, can be beneficial for drivers with few miles as well as those looking to develop safe driving practises and save money.

Final Words

One of GEICO’s biggest drawbacks is that several of its insurance plans, like life and homeowners, are underwritten by outside partners. Customers’ claims processes get more complicated as a result of this. Let’s say you wish to submit a home or life insurance claim. It can be a hassle for policyholders because they have to get in touch with the business that underwrites them rather than GEICO directly.